Bitcoin Wastes Energy!

“Salad consumes more energy than Bitcoin. Just imagine what we could do with all that sunshine!”

The “Bitcoin wastes Energy!” prejudice is one of the most often heard ones, and at the same time one of the most frowned upon ones for Bitcoiners, as it has been refuted excessively in countless articles, podcasts and videos – so usually, a person making this claim either doesn’t sufficiently understand Bitcoin’s value proposal, or he/she wants to attack the project for selfish reasons.

On this page, we will look at Bitcoin from several angles and show that in fact, Bitcoin does not ‘waste’ energy – rather just the opposite! -, and on top of that, Bitcoin provides a lifeboat for anyone exposed to our factually wasteful, current Fiat-based financial system – maybe even the world as a whole.

Bitcoin – by the very definition of this word – isn’t ‘wasteful’.

What is ‘waste’? In the Oxford Dictionary, ‘wasteful‘ is defined as ‘using or expending something of value carelessly, extravagantly, or not to purpose.‘ By this very definition (and isn’t the correct use of our language crucial for meaningful communication?), Bitcoin can’t be wasteful, as the electricity for mining (‘finding’ new blocks for the Bitcoin ledger in which transactions are confirmed and stored) is only used for exactly this purpose.

Bitcoin miners do not consume electricity carelessly, extravagantly and certainly not to no purpose. Waste would mean a) that this energy would be a good that would be used otherwise if it weren’t for mining, and b) that consumers of electricity should not be allowed to decide by themselves what they wish to use the electricity (a service, not a good!) for that they have purchased.

Where would this stop? Would gaming consoles be next, then microwave ovens, and finally, these horribly wasteful A/C’s during summer and heating during winter? What would the ‘saved’ energy be used for instead?

Also, explain to the half of the world living under authoritarian governments that ~1/3 of mining is still non-renewable and thus, we, the righteous people, want it stopped!

Bitcoin gives not only ourselves, but especially also these oppressed, unbanked or otherwise disadvantaged people something they never had before: a choice.

The Fiat system actually is wasteful.

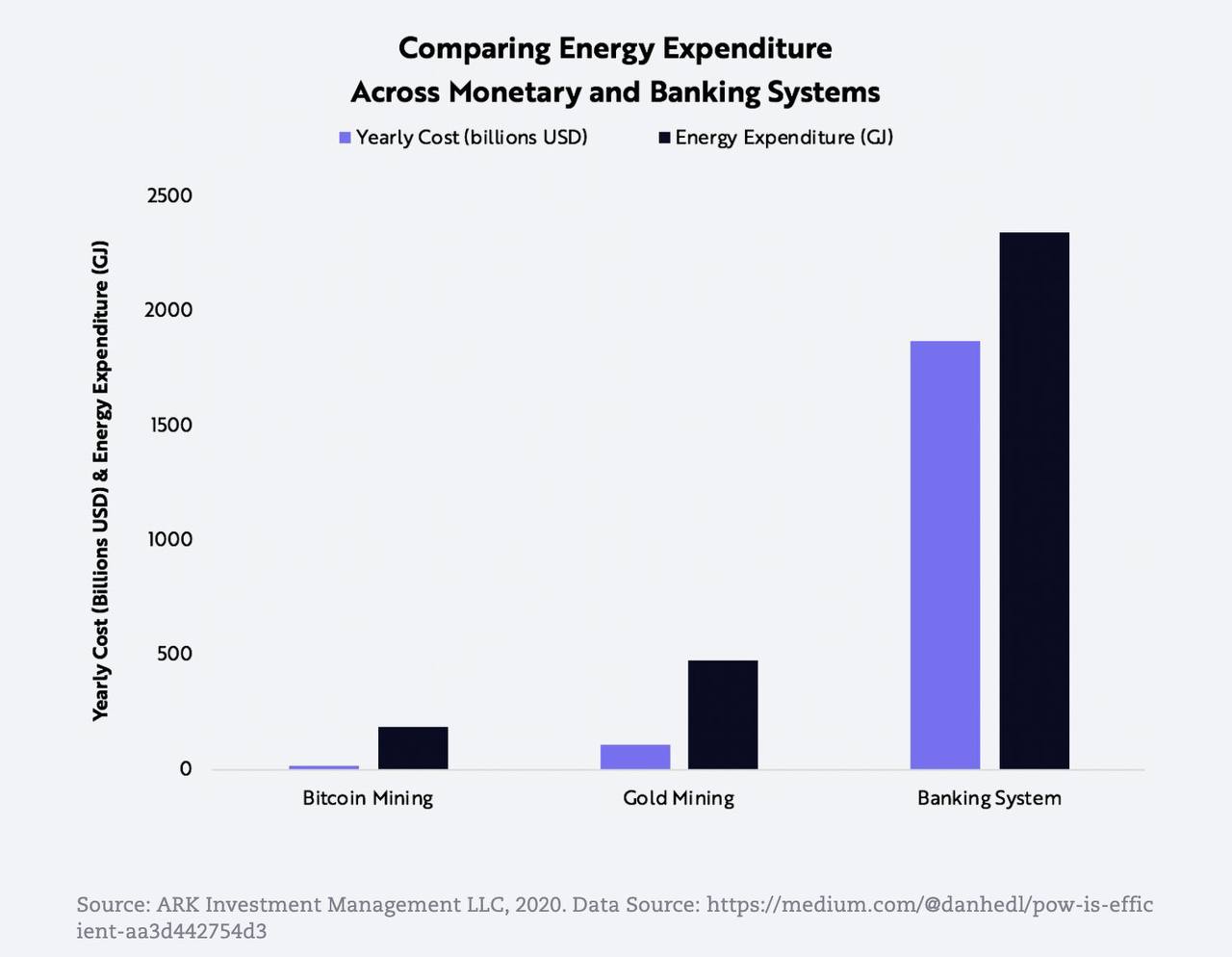

| Banking system | 140 TWh per year |

| Bitcoin | 32 TWh per year |

Worse environmental footprint. The Fiat money system, as a matter of fact, actually wastes electricity and has a massive carbon footprint compared to Bitcoin. Just comparing the electricity cost of a single Visa card transaction is completely ignoring the environmental impact of the massive infrastructure that sustains Fiat money and the enormous collateral damage that Fiat brings.

Distorts and corrupts economic activity. It is provably prone to cronyism, and distorting price signals lead to huge frictions and inequality. Economic activity can’t be properly coordinated by a manipulated medium of exchange and store of value, but is instead confounded by the decisions of a few who have been given the power to create money out of thin air, and then to distribute it to the entities close to them. As the Cantillon Effect describes: contrary to popular belief, this money doesn’t somehow ‘trickle down’ to the less fortunate, but remains stuck at the top of the distribution pyramid for most parts. As a result, much of the economic resources of a society is absorbed and wasted by debt that is put on the current and future generations…

Fiat-based economies go through boom and bust cycles – but rarely we see someone even mentioning the real price of Fiat’s recession phases: a high human toll and trillions of wealth destruction – wealth that took an enormous amount of resources (including carbon) to create. The carbon cost equivalence of these recessions is astronomical. If environmentalists took that into account instead of keeping it with superficial comparisons of ‘transactions’, the logical solution should be to base our economies on a non-inflationary asset with sound monetary principles, which we already have in Bitcoin.

Inflation produces garbage. On top of all that, soft money that is subject to devaluation incentivizes governments, corporations and individuals to consume rather than to save. Carefully pondering over necessary purchases and investments is considered a bad thing in Fiat-based economies, as it ‘doesn’t help the economy’ as we are told. But what really does happen is: it results in a constantly ‘melting’ stash of value. Money you don’t spend today will be worth less next week, so rather buy some cheap plastic product today, you can still replace it tomorrow when necessary! This dynamic, triggered by an ever-growing supply of money, results in a historically unique pile of garbage that our world is producing – a direct result of our fiat-dominated world economy, with citizens who are not only incentivized but even motivated to spend and to produce short-lived stuff rather than to save or to produce stuff that keeps its value for a long amount of time.

This is why the world may very well need a ‘Bitcoin standard‘ to turn things around … it won’t happen under a ‘Fiat standard’! We and the environment we live in will not be saved by spending even more taxes for a so-called ‘Green Deal’ – what we need is an ‘Orange Deal’. ![]()

Care for a few facts and numbers?

“Bitcoin mining, in its 10 years of existence, consumed as much as US cars alone do in 3 days.

(@khannib, 2019)

1790635332537685941996748800 hashes computed by S9 miners ~= 1.75 e17 joules ~= 4.2M tons of oil. US cars consume ~1.3M tons of oil per day.”

Bitcoin seeks out the inefficiency of the energy market at the edges: wasted hydro, flare, gas, solar, wind. It is not far-fetched to expect Bitcoin to make the whole, worldwide energy market to become more efficient. We can see it as a perpetual bounty program for innovation in energy production. Energy itself is not scarce – it’s all around us!

To get a better understanding of our reasoning in this article, it helps to understand a few basic concepts:

First off, we have to understand the difference between electricity production and electricity consumption. Power plants of any kind – be it a coal plant in China or a solar cell on your rooftop – convert a natural resource into electricity. This is called electricity production. Bitcoin mining converts electricity into hashes. This is called electricity consumption. Consumption itself does not create emissions – it is basically using a service that has been produced in and for the free market of goods and services. Who should be allowed to approve which uses of a purchased service are, and which are not acceptable? Where does it start … and where would it end? Ultimately, the most ‘ecological’ solution would for us to return to live in caves – without using fire of course, to avoid air pollution.

Another important point to consider: if there is more demand for energy, the incentives to develop power plants for renewables are increasing. Everyone (falsely, as this article hopefully clearly illustrates) ranting about Bitcoin’s ‘additional’ usage of energy seems to ignore this very simple fact: Bitcoin creates positive pressure for the development of energy efficiency. You can conclude from each of the sections in this article that in many ways, Bitcoin miners are actually the first entities optimizing their very own activities in exactly this manner: they try to optimize their mining farm locations, operation times, electricity sources etc. to utilize renewables. As one of the consequences, the percentage of renewable energy used for Bitcoin mining is increasing every year.

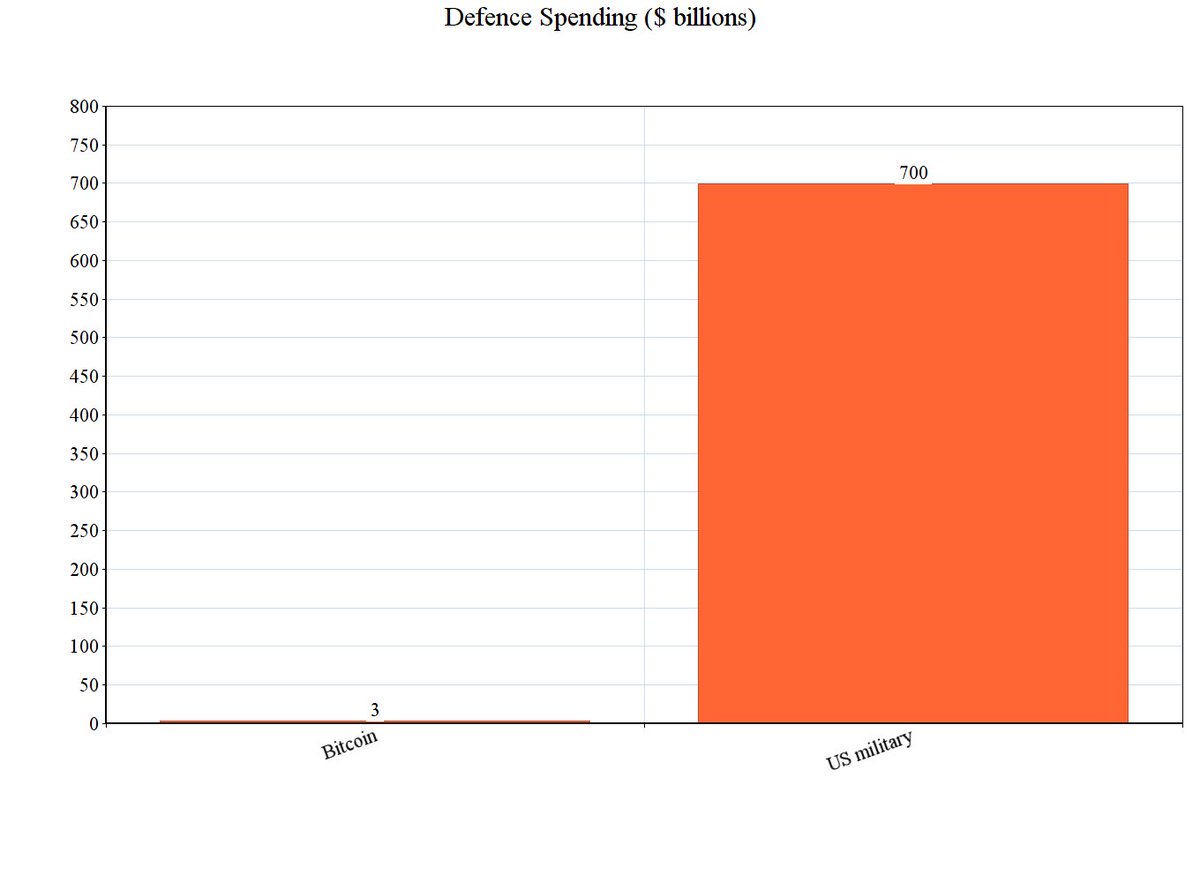

Image: “People, should we ban the banking system or gold mining?”

– Bitcoin has a carbon footprint of ~ 22mio tonnes. CF of 1 child = 60 tonnes, 1 car = 2.4 tonnes (equiv to 25 children) … so Bitcoin has the same CF of 360,000 children or 14,000 cars. Could we start by reducing the world population growth by 0.00000005% for one day? 😉

– oh, and just a short, final question: how much energy do YOU consume per day? Take a few minutes to calculate it honestly, including all the services and resources that went into it. And then justify every aspect of your energy usage. Thank you for your cooperation.

We can imagine Bitcoin as a race to the cheapest energy source.

Bitcoin miners are incentivized to look for cheap energy sources in order to maximize their gains on finding new blocks. The cheapest energy sources are usually the ones where there’s little competition from civilization. As a basic rule: the farther away from cities and the less effort to generate it on a continuous basis, the better. Until about 2011, it was still somewhat feasible to mine on personal computers, until 2016, it was with specialized mining devices (ASIC’s), but these days, mining has become a highly specialized industry which requires entrepreneurial, technical and economical skills and other knowledge in order to be sustainably successful. Because of that, new mining farms are often created close to natural energy sources, where with a minimum of construction efforts, preconfigured mining units and reasonable startup investments, mining can be done as long as possible and without requiring additional resources or capital injections. Renewable energy sources are perfect for this kind of enterprises: once set up and running, they can run virtually forever and require only a minimum of manpower, mechanical intervention and additional resources.

The optimal scenario for Bitcoin mining is to use spare energy – it’s always the cheapest one (sometimes even free), regardless of the source. Our power grids and the power stations that feed them are built with a capacity to cover everyone during the hottest summer days with all A/C’s turned on (or the coldest winter days with all of our heaters running)! This results in an enormous over-supply during 90% of an average year – the generated power is produced, but not used – ‘wasted’. This is ‘waste of energy’ (although we had little other choice so far)!

Now, however, we have a choice. Unlike power plants (for which this is a process that can take days up to several weeks), Bitcoin mining can be switched on and off by the flip of a button. Miners will enjoy the highest profits when they only switch on their farms during times of low energy consumption – during nights, or at average temperatures. Otherwise, the – continuously, and regardless of demand – generated electric power would just remain unused! The respective electricity would basically just ‘disappear’ without having helped anyone! On the other hand, should there ever be energy shortage, the electricity prices will go up – some miners will stop mining, which will make the consumption drop as well.

Wait, what about the heat?

Miners will always try to make their mining activity as efficient as possible. They are not happy if the electricity they have to purchase is turned into heat – they want it to be turned into Bitcoin! But that their mining rigs are turning part of this energy into heat and need to disperse it is part of a mining operation’s business that they accept. If a new, more efficient type of integrated circuit that mined without producing a lot of heat came on to the market, rational miners would switch to it for the power savings and increased profits, it is for this very reason why we find an increasing number of mining operations moving to cold countries or to locations where there is constant wind flow: in order to maximize natural cooling and minimize loss of energy.

The market encourages participants to strive for efficiency in both, energy production and efficiency of usage.

Why not simply replace Proof of Work?

Some Bitcoin skeptics who consider themselves open-minded, will even admit the necessity or at least utility of Bitcoin, but then end up asking: ‘why not at least make it more eco-friendly, and switch from Proof of Work (PoW) to another consensus model?’ This implies that PoW has no particular purpose that wouldn’t be relatively trivial to replace by some other ‘technique’ which would achieve identical goals, but requires ‘less energy’.

The fallacy begins with ignoring the aspect of unforgeable costliness (Nick Szabo): if an intended store of value is easy to create or reproduce, then more production will inevitably happen at some point, resulting in this store of value losing value over space and time. This is one of the major problems with most altcoins by the way: if they were printed out of thin air (a.k.a. ‘premined’), it is relatively trivial to print more of them given enough demand. In fact, we have witnessed this in plenty of projects that were introduced as ‘alternatives’ to Bitcoin: altcoins have been ‘frozen’, ‘minted by staking’, ‘put into escrow’, ‘burned’, inflation was introduced and/or removed etc. The goal was usually to re-adjust the number of tokens in circulation based on ‘needs’ that arose at some point, but at all times it basically just took a change in code or convincing parties who held power in the ecosystem in order for a casual number of tokens to be newly generated or destroyed.

With a token that can only be created if considerable amounts of time + energy are invested, there are limitations set by the laws of physics: both can’t be forged, and require ‘skin in the game’. Bitcoin sets the bar even higher, by adjusting the difficulty at which new blocks can be ‘mined’: so as we’ve learned by mainstream media, it now takes the ‘energy production of whole countries’ and requires specialized hardware to find (‘generate’) new Bitcoins. This massively improves Bitcoin’s security, but also hardens its monetary rules. For Bitcoin as a reliable form of hard money with a credible monetary policy and distribution rate it is actually an advantage, if not to say a super-power to require a ‘physical’ investment of energy + time to both generate and secure its monetary units and (via Bitcoin’s network of 10,000+ nodes verifying the correctness of the mined blocks and the transactions they contain) to prevent tricking or ‘bypassing’ its monetary rules – which has been the biggest problem of any form of money that humans ever used! Bitcoin is basically a world-wide, 24/7/365 honeypot for attacks on both, it’s security and monetary policy – but it has proven utmost resilience against all of these efforts so far.

We will add a separate article covering this and other attack vectors at a later point. The article you’re reading here is just an answer to the ‘energy waste’ attack vector, which is a social attack in order to create pressure on the Bitcoin community to switch to a weaker security model. But as you may start to understand by now, this won’t happen anytime soon! 😉

Energy use is an indicator of societal progress.

Whatever mankind values, he produces more efficiently:

– gold’s monetization led to more gold production

– Bitcoin will lead to more energy production

Isn’t that a bad thing?, you may ask. Not at all. Look at the history of mankind: whenever humans found a way to produce more energy, it led to new levels of progress, not only in a broad technological sense, but also with impacts on society and general wellbeing. Bitcoin, as already described above, incentivizes improving efficiency in energy production, which itself improves efficiency, wealth creation and living standards.

Almost infinite amounts of energy are available – increasing the efficiency in which we consume and store it moves us closer to a Type 1 civilization on the Kardashev scale.

Because of the above, Bitcoin is actually the long-term solution to climate change. For three reasons:

a) Bitcoin, unlike Fiat money, honors the principle that the primary reason any market good has value is the energy input of production. It can not be ‘printed’ out of thin air.

b) As a consequence, Bitcoin mining incentivizes utilizing & building renewable and otherwise unusable or unused energy sources.

c) As a consequence, Bitcoin directly and indirectly incentivizes long-term planning and saving.

The third consequence has massive potential in particular. Bitcoin by its very nature is hard, sound money – after the ‘halving’ of 2018 it’s ‘Stock to Flow‘ value has become similar to gold’s. So basically everyone who is holding (instead of spending) Bitcoin as money is better off in the long run. This incentivizes carefully evaluating whether anything one is spending money (Bitcoin) on is worth the expense or not. In other words, it triggers a domino effect of changes of thinking in times of historically unmatched amounts of plastic garbage, destruction of precious rainforests and turbo ‘production’ of goods that have no lasting value.

Ironically, it looks more and more as if we can’t save the world without Bitcoin. Efficient action and global coordination require a sound monetary base.

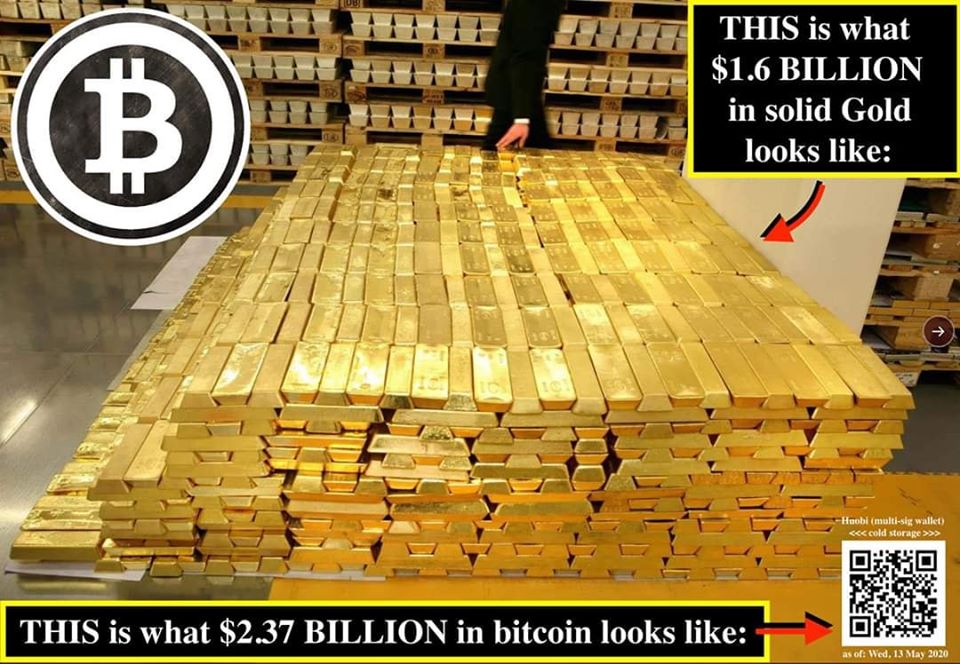

How about using gold instead of Bitcoin?

Money is a social technology used to solve a problem which has persisted for all of humanity’s existence: how to move and protect economic value throughout space and time. Since thousands of years, gold has fulfilled this role, it was the physical standard of money. Why is Bitcoin often called the digital standard of money, or ‘gold 2.0‘?

| Property | Bitcoin | Gold |

|---|---|---|

| Scarce (limited supply) | only in theory | |

| Durable | ||

| Portable | costly | |

| Verifiable | costly | |

| Divisible | not easy | |

| Fungible | ||

| Recognizeable | limited | |

| Storage cost | costly | |

| Microtransactions | ||

| Easy value transfer | ||

| Censorship resistance | ||

| Auditable supply | ||

| Programmable |

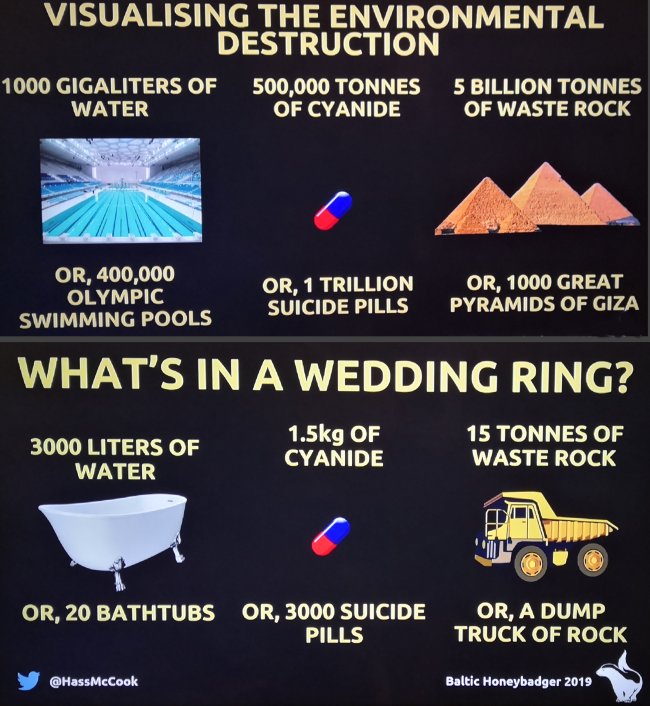

But how does gold hold up against Bitcoin – the digital standard for money – in terms of its environmental effects and sustainability of mining?

| Bitcoin | Gold | |

| Barrels of oil consumed for mining | 6.6 million barrels | 123.2 million barrels |

| Energy consumption (GJ) | 183,000,000 | 500,000,000 (mining & recycling) |

| USD cost per GJ | $25 | $1,821 |

Gold mining is one of the most destructive industries in the world. It can displace communities, contaminate drinking water, hurt workers, and destroy pristine environments. It pollutes water and land with mercury and cyanide, endangering the health of people and ecosystems.

Bitcoin doesn’t require all that. It seeks the most efficient, usually renewable forms of energy or energy that isn’t used for anything else. Bitcoin is the better gold.

Energy corporations mining Bitcoin – isn’t that bad?

Okay, so you’ve read several sections on why the energy-related concerns about Bitcoin might be strongly exaggerated, or even completely miss the point – but one question remains: why are we currently seeing an increasing number of corporations, namely energy producers, getting into Bitcoin mining?

The CEO of Norway’s Aker Corporation (one of Europe’s largest energy producers), Kjell Inge Røkke, probably described it best in their 2021 shareholder’s newsletter, explaining why he founded SeeTee, a new company that will invest in the Bitcoin ecosystem but also look for reciprocal effects with Aker’s very own operations:

“Mining operations (…) transfer stranded or intermittent electricity without stable demand locally —wind, solar, hydropower— to economic assets that can be used anywhere. Bitcoin is, in our eyes, a load-balancing economic battery, and batteries are essential to the energy transition required to reach the targets of the Paris Agreement.”

Bitcoin creates a global liquid market in electricity. Cheap energy anywhere on the planet can be monetized and act as a global subsidy for energy production, which itself invites for massive investments in off-grid energy sources. It will pay to invest in utilizing stranded or unused energy sources – which by itself will gradually kill energy subsidies (particularly for such using ‘dirty’ forms of energy generation!), which is great for efficiency and sustainability.

Notable and very interesting projects apart from the one of Aker are Great American Mining (specialized in utilizing stranded or flared gas to mine Bitcoin, thus reducing carbon emissions) or UpstreamData, specialized in utilizing methane gas (their portable Bitcoin mining datacenters reduce carbon emissions by over 0.3 metric tonnes per year for every $1 in capital deployed!).

And then there is an ever-growing number of projects focusing on green mining, like Argo’s TerraPool, the first Bitcoin mining pool exclusively mining with 100% clean energy, and even the first progressive and modern cities with politicians realizing the enormous potential of Bitcoin and trying to create a favorable but also guided environment for mining, like Kentucky‘s bill of March 2021, HydroCryp‘s massive projects for Paraguay or the “Golden Goose Project” also in Paraguay, which will soon utilize the massive excess energy produced at the Itaipu hydropower dam for Bitcoin mining, or Neptune‘s recently announced ambitioned green energy mining project in Alberta, Canada (planned expansion into other countries).

Great times ahead. And open-minded forward-thinkers are rewarded – as usual.

Mining secondary use

Over the years, people have come up with very creative ideas about how to ‘utilize’ mining beyond just discovering new bitcoins – in other words, to achieve positive side effects when already converting energy into electricity.

- BitBoiler – a DIY water & room heater for homes, factories, greenhouses, …

- BitcoinHotTub – a.k.a. SPA-256, using mining exhaust heat to heat water

[we know that there are several other projects and creative ideas on how to put mining to ‘secondary use’ – please let us know through the contact form or the comment section if anything is missing here!]

Further reads

- “Bitcoin is Key to an Abundant, Clean Energy Future” by Bitcoin Clean Energy Initiative (BCEI), I recommend listening to the audible version which also includes a commentary explaining a few of the concepts and technical details

- “How Much Energy Does Bitcoin Actually Use?” by Nic Carter, and

- “The Last Word on Bitcoin’s Energy Consumption” (video)

- “No, Bitcoin won’t boil the Oceans” (by Elaine Ou, Bloomberg article)

- “Does Bitcoin Use “Too Much” Energy?” by Allan Stevo, Mises Institute

We can conclude:

“Bitcoin is the most energy-efficient savings technology ever discovered.“

(Pierre Rochard)

Please let us know in the comment section or through the comment form if you have additional ideas, found disputable claims or data, or simply want to share your thoughts about this topic!

1 Comment

I think this topic will be of major importance for the next few years, maybe the main angle of governments to fight Bitcoin, because most people still don’t know better and just repeat what ‘influencers’ are telling them.